Stakeholders and Material Topics

-

Identification of

Material Topics -

Stakeholder

Identification -

Stakeholder

Engagement -

Material Topic

Identification & Prioritization -

Impact Assessment

& Performance

Indicators

Identification of Material Topics

Impact Management Mechanism

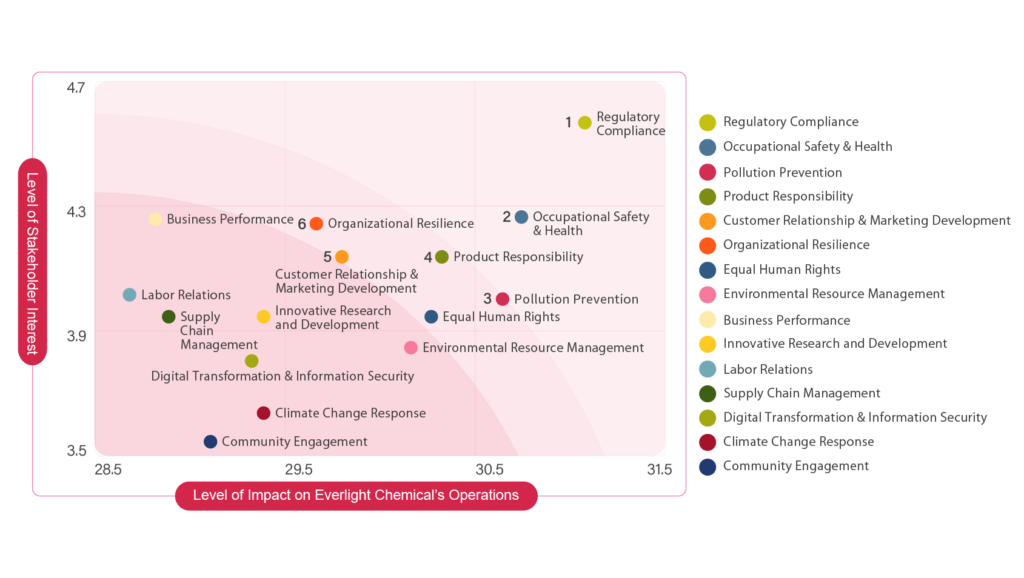

Process to Determine Material Topics

Process | Description |

1. Identify stakeholders | Every two years, Everlight Chemical conducts stakeholder identification and survey on stakeholder interests in terms of material topics. The latest stakeholder identification was conducted in 2021 based on the five principles of the AA1000 Stakeholder Engagement Standard (AA1000SES). We identified seven groups of stakeholders: shareholders/investors, customers/brand owners, employees, suppliers/contractors, nearby communities, government agencies and banks. In 2022, the ESG Committee resolved that no change was needed to the seven categories of stakeholders. |

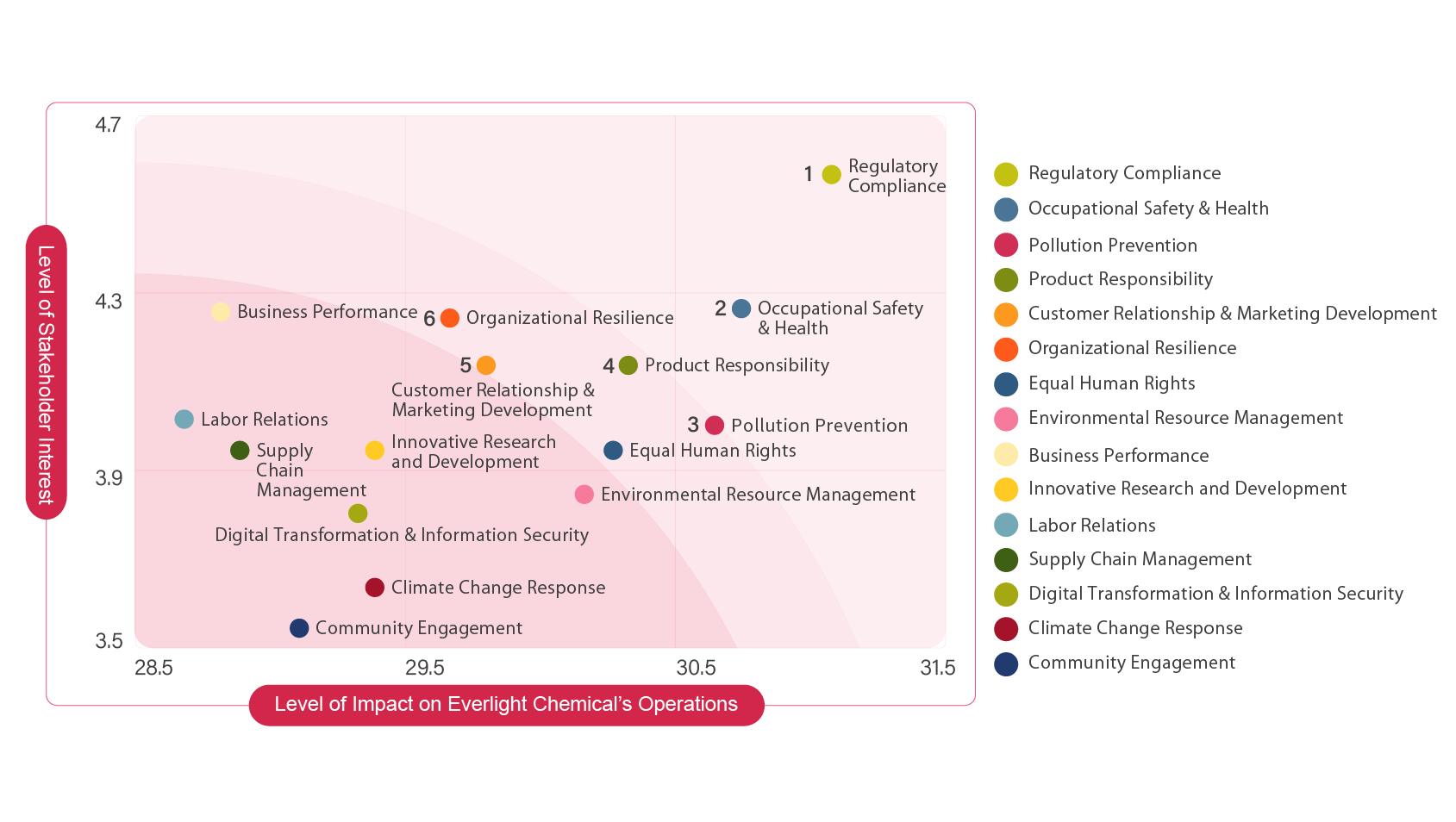

2. Source of potential material topics | We developed a list of 15 sustainability topics for further materiality assessment based on international ESG trends, GRI Standards, SASB Standards for the Chemicals industry, requirements of international ESG rating institutions and the TWSE Corporate Governance Evaluation for Listed Companies by the Financial Supervisory Commission (FSC). The topics include: 1. Business Performance, 2. Innovative Research and Development, 3. Customer Relationship and Marketing Development, 4. Organizational Resilience, 5. Regulatory Compliance, 6. Digital Transformation and Information Security, 7. Product Responsibility, 8. Supply Chain Management, 9. Labor Relations, 10. Occupational Safety and Health, 11. Equal Human Rights, 12. Community Engagement, 13. Environmental Resource Management, 14. Pollution Prevention, and 15. Climate Change Response. |

3. Survey on stakeholder interests | In July 2021, through various channels of communication and using online questionnaires, we conducted a comprehensive survey to capture stakeholders’ interests on the potential material topics. A total of 180 questionnaires were distributed, and 151 were completed and returned, representing a survey response rate of 83.8%. |

4. Assess the significance of impacts on the economy, environment, and people (including human rights) | We interviewed department managers and distributed 30 questionnaires to assess the scope and degree of involvement in the positive and negative impacts, assessing the scale and likelihood of impacts under each topic. |

5. Assess the impact of sustainability topics on Everlight Chemical’s operations | Besides assessing the Company’s impacts on the economy, the environment, and people (including human rights), we also evaluated the level of impact the sustainability topics could have on the Company’s operations, including both actual and potential impacts. |

6. Determine material topics | Based on the level of stakeholder interests and the significance of impacts under each topic, we mapped out a materiality matrix and, in the order of priority, determined on six material topics for management and reporting. The topics include: Regulatory Compliance, Occupational Safety and Health, Pollution Prevention, Product Responsibility, Customer Relationship and Marketing Development, and Organizational Resilience. |

7. Analyze how the material topics relate to UN SDGs and devise performance indicators | Four UN Sustainable Development Goals (SDGs) were selected based on relevance: #6 Clean Water and Sanitation, #7 Affordable and Clean Energy, #12 Responsible Consumption and Production, and #13 Climate Action. |

8. Confirm on material topics for reporting and corresponding management approaches and performance indicators | Devising performance indicators: Based on our latest assessment of positive/negative impacts and due diligence in response to the updated GRI Universal Standards (2021), we added a new material topic, Customer Relationship and Marketing Development, to demonstrate Everlight Chemical’s commitment to high-quality sustainable products and green chemistry practices. In response to the GRI Standards update, SASB standards, the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations and net-zero emissions trends, we selected a total of 18 key performance indicators, including newly added metrics like fines incurred, frequency-severity indicator (FSI), share of revenue from sustainable products, progress on implementing a process safety management (PSM) system, product quality level (σ), share of sales revenue from new products, customer satisfaction, employee turnover rate, monthly availability rate of critical information systems and network services, on-time delivery rate, share of mid/high-risk suppliers, number of mid/high-level risks addressed, etc. Based[1] on these indicators, we have developed action plans and follow-up mechanisms, assigning tasks and responsibilities across functions and departments, with the aim to enhance our positive contribution to the economy, environment and people and mitigate negative impacts. |

2022 List of Material Topics

Stakeholder Identification

Step 1

Step 2

Step 3

Shareholders/Investors

Providers of working capital for the Company

Customers/Brand Owners

Purchaser of the Everlight Chemical’s products who also negotiate the terms of delivery and coordination needed from us

Employees

Those who carry out the Company’s day-to-day operations. Employees are key internal stakeholders

Suppliers/Contractors

Suppliers of raw materials, components or equipment or contractors engaged by the Company to perform construction or maintenance projects. Resources and services from these stakeholders enable each part of our business to function smoothly

Nearby Communities

Organizations near our production facilities, including nearby factories, schools, communities, industrial park service centers, etc.

Government Agencies

Competent authorities relevant to our business (e.g., central government agencies, city and county governments, fire stations, police departments, government agencies related to labor or environmental safety, the Financial Supervisory Commission, etc.)

Banks

Financial institutions that provide financing for the Company

Stakeholder Engagement

Shareholders/

Investors

- Business operation and profitability

- Corporate governance

- Operational strategy

- Investment plans

- Annual reports and annual general meetings (annual)

- Company website and the Market Observation Post System of TWSE (year-round)

- Investor hotline and mailbox (year-round)

- Investor conferences (2 times/year)

We have complied with all regulatory requirements: issuance of an annual report, holding shareholders meetings and investor conferences.

Customers /

Brand Owners

- Business operation and profitability

- Green innovation and green products

- Environmental responsibility

- Customer satisfaction survey (annual)

- Client visits and/or audits (ad hoc)

- Dealer conferences (annual)

- Company website, phone line and email communications (year-round)

(1) Each business unit held their annual dealer conference and also arranged client visits.

(2) We provided clients with documentation on our ESG practices and allowed for on-site inspections by clients.

(3) We continued to do our best in fulfilling customer needs and creating value with customers.

Employee

- Business operation and profitability

- Employee benefits and protection

- Working conditions

- Internal meetings (labor consultations, manager meetings, monthly meetings, etc.)

- Internal committees (for occupational safety and health, meal services, anti-sexual harassment, etc.)

- 1-1 meetings or satisfaction surveys (annual)

- Employee mailbox and public announcement bulletin

- Welfare committee meetings (quarterly)

Suppliers/

Contractors

- Supplier management

- Environmental management

- Business integrity

- Supplier visits and/or audits (ad hoc)

- Supplier training

- Company website, phone line

- Email communications (year-round)

Nearby Communities

- Environmental responsibility

- Social welfare

- Personnel visits (ad hoc)

- Participation in community meetings

- Participation in community activities

Government Agencies

- Corporate governance

- Environmental responsibility

- Labor relations

- Participation in info sessions and educational activities

- Participation in symposiums and seminars

- Fulfilling filing and reporting duties and complying with on-site inspections

- Communication via official correspondence and phone

Everlight Chemical assigned representatives to participate in all relevant government info sessions and activities to understand actions needed on the Company’s end. Besides fulfilling legal reporting duties and allowing inspections across business divisions, we also proactively sought guidance from competent authorities through phone calls or in-person visits.

Banks

- Business operation and profitability

- Corporate governance

- Personnel visits (ad hoc)

- Company website (ad hoc)

- Phone communication (ad hoc)

Shareholders/ Investors

Topic of Interest:

- Business operation and profitability

- Corporate governance

- Operational strategy

- Investment plans

- Annual reports and annual general meetings (annual)

- Company website and the Market Observation Post System of TWSE (year-round)

- Investor hotline and mailbox (year-round)

- Investor conferences (2 times/year)

All communication frequencies and goals were achieved.

We have complied with all regulatory requirements: issuance of an annual report, holding shareholders meetings and investor conferences.

Customers / Brand Owners

- Business operation and profitability

- Green innovation and green products

- Environmental responsibility

- Labor relations

- Customer satisfaction survey (annual)

- Client visits and/or audits (ad hoc)

- Dealer conferences (annual)

- Company website, phone line and email communications (year-round)

Implementation in 2022:

All communication frequencies and goals were achieved.

We have passed all customer/brand owner audits and inspections in 2022, and have earned a firmwide customer satisfaction score of 90 (vs the target of > 88).

Key accomplishments:

(1) Each business unit held their annual dealer conference and also arranged client visits.

(2) We provided clients with documentation on our ESG practices and allowed for on-site inspections by clients.

(3) We continued to do our best in fulfilling customer needs and creating value with customers.

Employees

- Business operation and profitability

- Employee benefits and protection

- Working conditions

- Labor relations

- Internal meetings (labor consultations, manager meetings, monthly meetings, etc.)

- Internal committees (for occupational safety and health, meal services, anti-sexual harassment, etc.)

- 1-1 meetings or satisfaction surveys (annual)

- Employee mailbox and public announcement bulletin

- Welfare committee meetings (quarterly)

Internal meetings were held (including regular monthly meetings, monthly meetings of the Environment, Health Safety (EHS) Committee, ad-hoc manager meetings, ad-hoc labor- management consultation meetings, etc.) to communicate important information. Managers also discussed career development prospects with employees and provided necessary support at the semiannual performance review meetings.

Suppliers/Contractor

Topic of Interest:

- Supplier management

- Environmental management

- Business integrity

- Supplier visits and/or audits (ad hoc)

- Supplier training

- Company website, phone line

- Email communications (year-round)

For supplier management, we conduct supplier surveys annually based on the risk profile (high-, mid- and low-risk), product category (raw materials, equipment) and level of business relationship (critical/major/new suppliers) of our suppliers. For the survey results, please refer to the Supply Chain Management section of our sustainability report or our official website.

Nearby Communities

- Environmental responsibility

- Social welfare

- Personnel visits (ad hoc)

- Participation in community meetings

- Participation in community activities

1. Active participation in community activities and local visits Each plant assigned dedicated personnel to regularly pay visits to local borough chiefs (generally on a quarterly basis). We also actively participated in/assisted with community disaster prevention efforts, donated pandemic relief supplies, participated in the river adoption program, held beach cleanup days, and supported local elementary and high schools through donations. In 2022, a total of 98 community consultations were conducted. Topics of discussion included: industrial safety (fire prevention), air quality, waste management, sponsorship for community activities/school clubs, emergency response drills of mutual-aid groups, tree adoption program, etc. All units engaged in meaningful communication and have taken practical measures to address related concerns. 2. Community Satisfaction Survey In the fourth quarter of 2022, we conducted our first plant-level Local Community Satisfaction Survey, recording a satisfaction rate of 95.2% from 29 samples. All questions related to corporate image received high scores (9.7 out of 10), while questions related to waste management at related facilities received a relatively lower score (9.1 out of 10). Each plant will continue to communicate with neighboring communities the Company’s efforts in environmental protection.

Government Agencies

- Corporate governance

- Environmental responsibility

- Labor relations

- Participation in info sessions and educational activities

- Participation in symposiums and seminars

- Fulfilling filing and reporting duties and complying with on-site inspections

- Communication via official correspondence and phone

Implementation in 2022:

Everlight Chemical assigned representatives to participate in all relevant government info sessions and activities to understand actions needed on the Company’s end. Besides fulfilling legal reporting duties and allowing inspections across business divisions, we also proactively sought guidance from competent authorities through phone calls or in-person visits.

Banks

- Business operation and profitability

- Corporate governance

- Personnel visits (ad hoc)

- Company website (ad hoc)

- Phone communication (ad hoc)

We regularly communicated with banking personnel, usually through phone calls, to ensure effective communication.

Material Topic Identification and Prioritization

Changes to the List of Material Topics: 2022 vs. 2021

2021 Material Topics (in the order of priority) | 2022 Material Topics (in the order of priority) |

|

|

Material Topic Impact Assessment and Performance Indicators (Target & Actual Performance in 2022)

Assessment of Positive and Negative Impacts for Material Topics

No. | Material Topic | Positive/Negative Impact Rating (P/N, Score: 1-4) | Scope of Impact / Degree of Involvement | Key Performance Indicators (KPIs) | 2020 Target | 2022 Actual | ||||||

Impact Level | Likelihood | Description | Shareholders | Customers | Employees | Suppliers | Communities | |||||

1 | Regulatory Compliance | P: 4 N: 2 | 4 | Positive Impact: Everlight Chemical has always prioritized compliance with laws and regulations, fostering positive corporate image and influence Negative Impact: We have incurred fines in environmental and social aspects in 2022, but has since conducted reviews and made improvements | ☐ | ○ | ● | ☐ | ● | (1) Fines Incurred (NT$0,000) | 0 | 45.5 |

2 | Occupational Safety and Health | P: 4 N: 2 | 4 | Positive Impact: Everlight Chemical is committed to its zero-accident mission and has taken measures to mitigate related risks Negative Impact: A fire incident occurred due to inadequate preventive measures. Immediate corrective actions had been taken | ☐ | ● | ○ | (2) Frequency-Severity Indicator(FSI) | 0 | 0.01 | ||

3 | Pollution Prevention | P: 4 N: 1 | 4 | Water Resource Management: We continued to reduce our water consumption and ensure regulatory compliance in terms of wastewater discharge, minimizing our environmental impacts. We outperformed our target for 2022. | ● | ● | ☐ | (3) Water Recovery Rate (R2)(%) | ≧ 83 | 93 | ||

P: 4 N: 2 | 4 | Air Pollution Prevention: We aim to reduce our air pollution emissions to mitigate environmental impacts. Yet we missed our target in 2022 due to the fire incident. We have made immediate improvements accordingly | ● | ● | ☐ | (4) Emissions Reduction Rate per Unit of Production (%) | ≧ 5 | -3 | ||||

P: 4 N: 2 | 4 | Waste Management: Waste recycling is an important focus of our circular economy practices and helps reduce negative impacts on the environment. We also use atom efficiency as an indicator of resource utilization efficiency. A high atom efficiency rate indicates less waste is produced. We outperformed the targets set for 2022 | ● | ● | ☐ | (5) Waste Recycling and Reuse Rate (%) | ≧ 70 | 72 | ||||

(6) Proper Disposal Rate of Hazardous Industrial Waste (%) | 100 | 100 | ||||||||||

(7) Recycling Rate of Hazardous Industrial Waste (%) | ≧ 3.1 | 4.3 | ||||||||||

(8) Atom Efficiency (%) | ≧ 66.6 | 70.9 | ||||||||||

4 | Product Responsibility | P: 4 N: 1 | 4 | We continued to increase the proportion of revenue generated by sustainable products and improve the use-phase efficiency/benefits of our products. We also further promoted process safety to prevent hazards and negative impacts. We have achieved our 2022 targets | ● | ● | ☐ | (9) Percentage of Revenue from Sustainable Products (%) | ≧ 56 | 56 | ||

(10) Progress on Establishing Process Safety Management (PSM) Systems | 完成 | 完成 | ||||||||||

5 | Customer Relationship & Marketing Development | P: 4 N: 2 | 4 | Relevant indicators include product quality level, share of sales revenue from new products and customer satisfaction. In 2022, our performance on these indicators all surpassed the targets set for the year. | ● | ● | ☐ | (11) Product Quality Level (σ) | ≧ 3.2 | 2.8 | ||

(12) Percentage of Sales Revenue from New Products (%) | ≧ 13 | 14 | ||||||||||

(13) Customer Satisfaction (Score) | ≧ 88 | 90 | ||||||||||

(14) Employee Turnover Rate (%) | ≦ 1.5 | 1.2 | ||||||||||

6 | Organizational Resilience | P: 4 N: 1 | 4 | Organizational resilience involves various aspects, including labor relations (employee turnover rate), information security (monthly availability rate of critical information systems and network services), supplier management (on-time delivery rate, proportion of mid/high-risk suppliers) and risk management (number of mid/high-level risks addressed). We have assigned relevant functions and departments to manage impacts in these aspects accordingly | ☐ | ○ | ● | ☐ | ☐ | (15) Monthly Availability Rate of Critical Information Systems and Network Services (%) | ≧ 90.5 | 100 |

(16) On-time Delivery Rate (%) | ≧ 85 | 85 | ||||||||||

(17) Share of Mid/High-Risk Suppliers (%) | ≦ 3 | 3 | ||||||||||

(18) Number of Mid/High-level Risks Addressed | 6 | 7 | ||||||||||

KPI | 2022 | Reason for Underperformance | Response and Improvement | |

Target | Actual | |||

(1) Fines Incurred (NT$0,000) | 0 | 45.5 | 1. Pharmaceutical Factory: Fined NT$60,000 (for the declared amount of toxic chemical substances did not match the actual stored amount onsite). 2. ECIC Plant III: A fire broke out at the plant on March 10, incurring fines of NT$180,000 in total. 3. Trend Tone Imaging: Fined NT$60,000 (Reason: failing to modify the name of statutory responsible person in the approval document for toxic chemical substances). 4. Trend Tone Imaging: Fined NT$150,0000 for requiring foreign employees to work beyond overtime limits. 5. Trend Tone Imaging: Fined NT$750 for late filing of tax returns. 6. Everlight Suzhou: Fined RMB 1000 for failing to label the source brand of raw materials per customs regulations.

| 1. Besides enhancing manager oversight, we also strengthened our control measures utilizing the government’s Toxic and Concerned Chemical Substances Registration and Declaration System. 2. Each factory conducted a comprehensive review of safety measures to prevent fire incidents from happening again. 3. A Checklist for Modification of Statutory Responsible Person was established, based on which related personnel will be reminded with email notifications going forward. 4. We have promptly added more manpower to our production lines to avoid exceeding overtime limits in the future. |

(4) Emissions Reduction Rate per Unit of Production (%) | ≧ 5 | -3 | The production volume of solvent products increased at ECIC Plant II and ECIC Plant IV (contributing to around 60% of the decrease in emissions reduction rate per unit of production), and the inspection results of equipment components at ECIC Plant III for 2022 Q3 showed a slight deviation from normal levels (contributing to around 40% of the decrease in emissions reduction rate per unit of production). | 1. We have requested each plant to strengthen self-inspection and maintenance to restore the calibration of equipment components to normal levels. 2. The product coefficient is not a controllable factor and should be reported based on actual operations. |

(11) Product Quality Level (σ) | ≧ 3.2 | 2.9 | Underperformance in this indicator resulted from significant changes to the production process of two products. | We have identified the causes of unstable production processes with these two products and have taken effective countermeasures. |