Climate Change Response and Adaptation

I. Governance

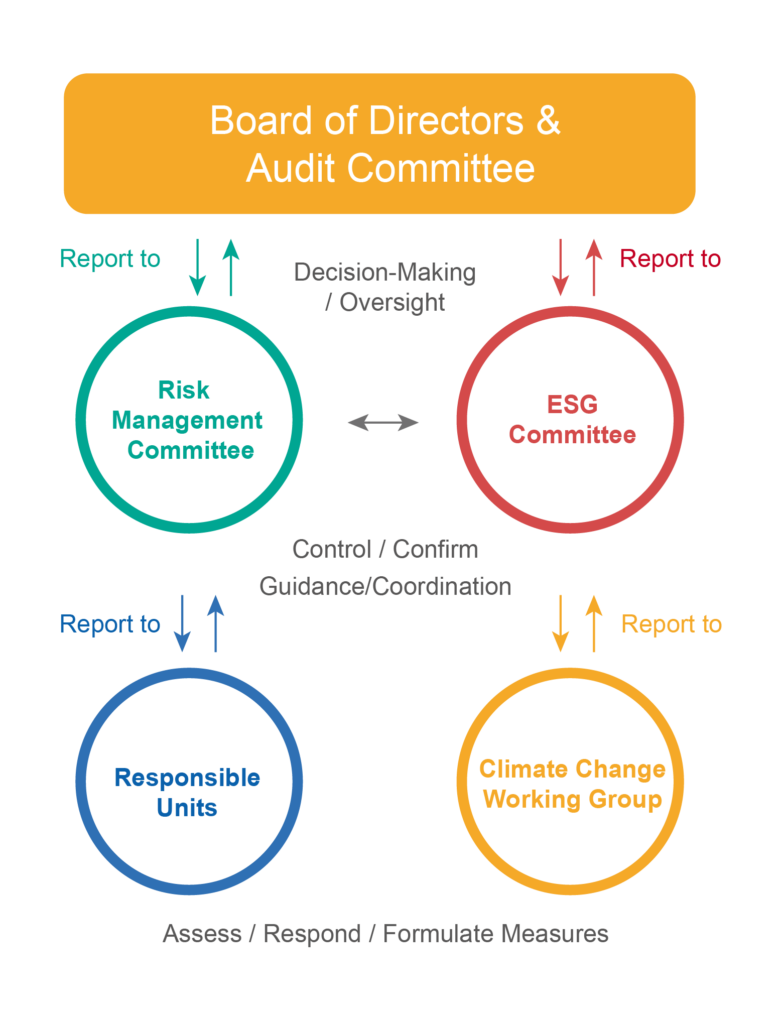

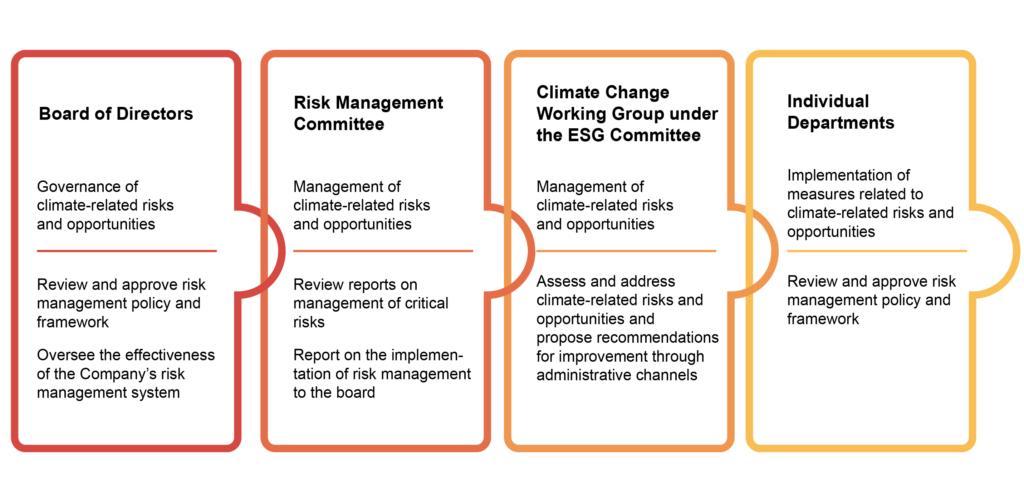

The Company’s Board of Directors is the highest governance body for climate-related risks and opportunities. The Board of Directors and the Audit Committee are responsible for overseeing the effectiveness of risk controls. In addition, the board has established the Risk Management Committee and Sustainable Development (ESG) Committee as responsible units for the assessment of matters on climate-related impacts. Board members have a thorough understanding of the significance and impact of climate change and factor impacts of climate change issues when making major investment decisions.

➤ Management Committee: The committee is chaired by the chairman of the board. The committee holds at least two meetings each year to discuss risk-related issues and reports risk management results to the board. Climate-related risks are classified as environmental risks.

➤Sustainable Development (ESG) Committee: The committee is chaired by the chairman of the board. The Governance Team, Environment Team and Social Team are established under the committee.

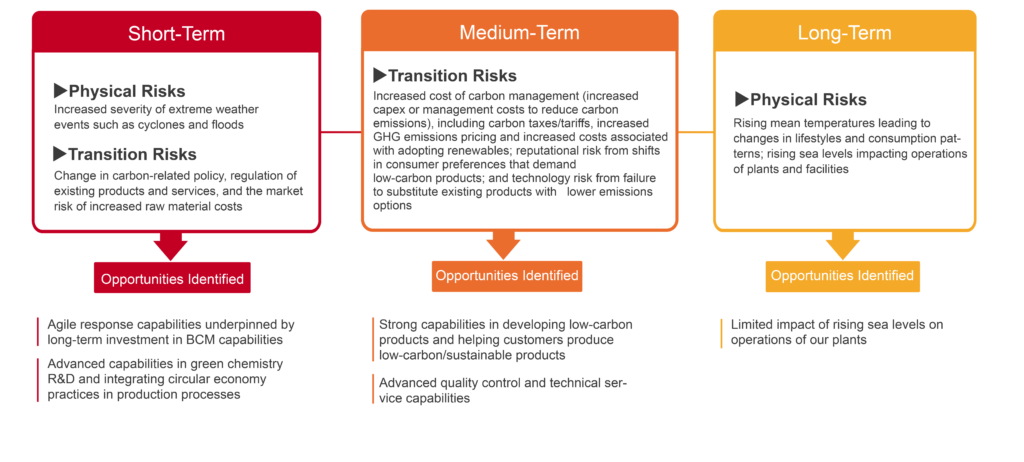

II. Strategy: Short-/Medium-/Long-term Climate-related Risks & Opportunities Identified

- Description of Climate-Related Risks & Opportunities Identified

- Taking Actions–Responding to Transition Risks & Opportunities

Mitigation/Adaptation Measures | Description | 2021-2023 Actions/Plans |

Develop Sustainable Products | Develop green/sustainable products that improve use-phase efficiency and reduce energy/resource consumption during production processes | Everzol ERC Solution (reactive dyes for cotton) from the Color Chemical Business Unit provides dyeing solutions with better energy efficiency, which enable a reduction of 10,000 tCO2e in GHG emissions. |

Develop Green Chemistry Production Techniques | Apply green chemistry principles in product design and production | We implement the 12 Principles of Green Chemistry in our product design and have received the Green Chemistry Application & Innovation Award by the Environmental Protection Administration in 2019 and 2021 |

Promote Circular Economy Practices | Increase resource efficiency by collaborating with others in the industry | We have been implementing circular economy practices for years and have received the TCIA Circular Economy Award in 2021 |

Implement Energy Management Measures | Establish energy management systems per ISO 50001 to improve energy-related performance | The Company has established ISO 90001 and ISO 14001 systems and plan to obtain ISO 50001 certification in 2023 |

Carbon Footprint Assessment Project | Adopt the ISO 14064-1:2018 GHG inventory system Adopt the ISO 14067:2018 carbon footprint analysis system | Organizational carbon footprint assessment & verification plans: Obtain verification for parent company in 2023 Obtain verification for entire group in 2024 Product-based carbon footprint assessment & verification plans: Obtain verification for selected products starting from 2023 |

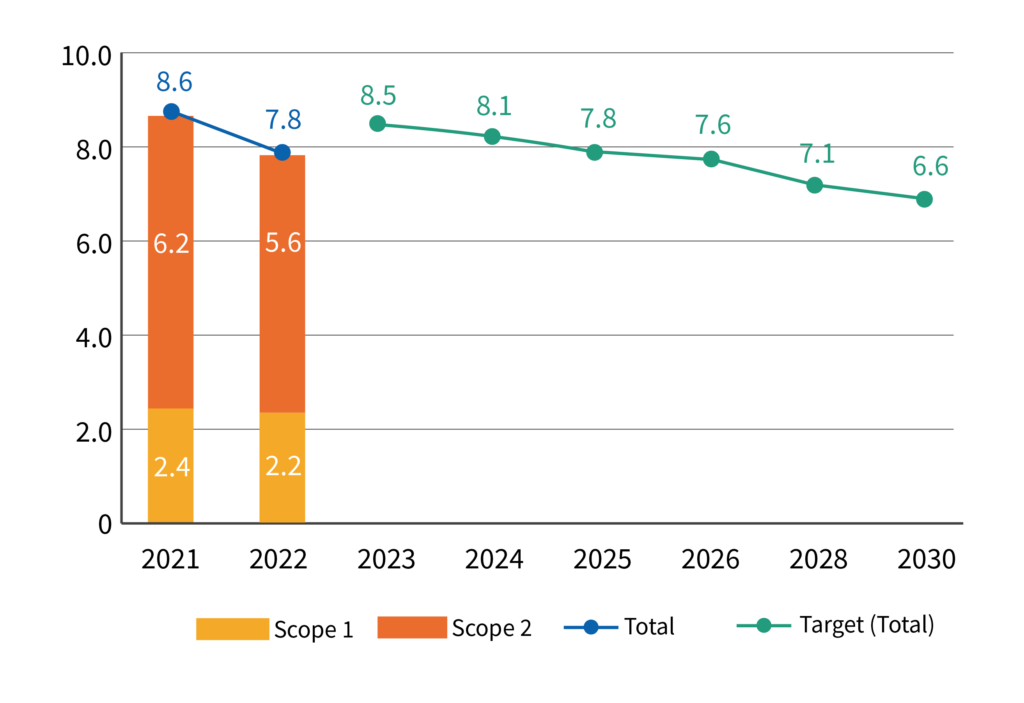

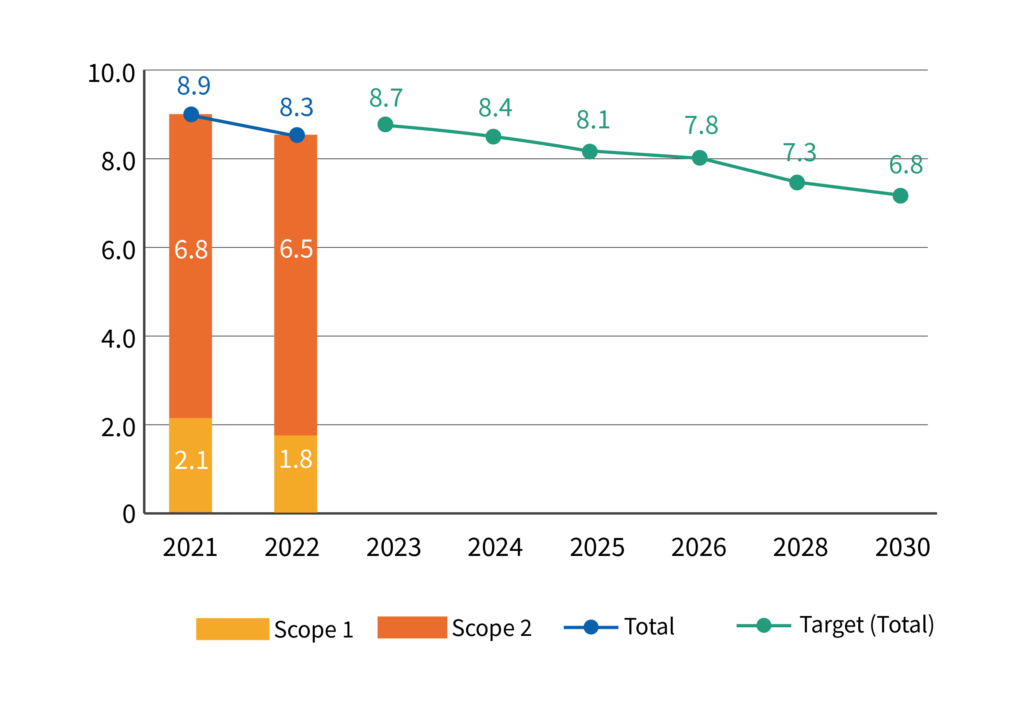

Carbon Footprint Verification & Reduction Pathway Project | Establish clear carbon reduction goals and emissions reduction pathway for the next decade | In 2022, a 24% emissions reduction goal by 2030 was proposed based per expert guidance and recommendation (with financial impact and feasibility assessment in progress, which will be submitted for board review and approval) |

- Short-Term: Increase production and distribution efficiency, and apply new technologies to develop low-carbon production processes

- Medium-Term: Accelerate the development of environmentally-friendly and sustainable products

- Long-Term: Achieve carbon neutrality/net-zero carbon emission goals

Mitigation and adaptation strategy considerations include product development and manufacturing, supply chain management, market trends and operations, etc. Our carbon management approach is based on the five product categories the Group offers. Based on major risks and opportunities identified, we have conducted a comprehensive evaluation of the low-carbon transition measures needed and the potential financial impact before and after these measures are implemented, so as to effectively grasp the overall financial impact and devise response strategies and timelines.

Description & Financial Impact of Climate-Related Risks & Opportunities Identified

Type | Risk and Opportunity | Related Impact | Financial Impact | Action Taken | Type of Financial Impact |

Risk | Increased cost associated with renewables | Potential increase in cost of renewable energy due to increasing demand and slow development of green energy sources. | Medium to high negative impact | Introduce the ISO 50001 system to improve energy efficiency; replace equipment for better energy conservation | Increased capital expenditure; increased operating costs |

Carbon tax / carbon pricing | Impact on the competitiveness of high-carbon products due to expanded regulation of the EU’s Carbon Border Adjustment Mechanism (CBAM) and global adoption of carbon pricing | Introduce energy management system; implement carbon footprint assessment and carbon management | Increased operating costs | ||

Increased cost of raw materials | Shortage or increased cost of raw materials due to climate change-related requirements and standards | Medium negative impact | Implement carbon footprint assessment and carbon management | Increased operating costs | |

Market/Consumer shifts to low-carbon products | Carbon pricing leading to increased consumer scrutiny on the carbon emissions of products or services, affecting the competitiveness of high-carbon products | Develop low-carbon products; develop sustainable products and sustainable development blueprint | Increased operating costs | ||

Opportunity | Necessity to develop low-carbon products | Carbon pricing leading to increased consumer scrutiny on the carbon emissions of products or services, affecting the competitiveness of high-carbon products | Medium to high positive impact | Develop production technologies that implement green chemistry principles; promote circular economy practices | Revenue from green products |

Development of sustainable products for carbon reduction at user’s end | Necessity to develop products with lower carbon emissions at the user’s end due to shifts in market/consumer preferences | Develop sustainable products and sustainable development blueprint | Revenue from green products |

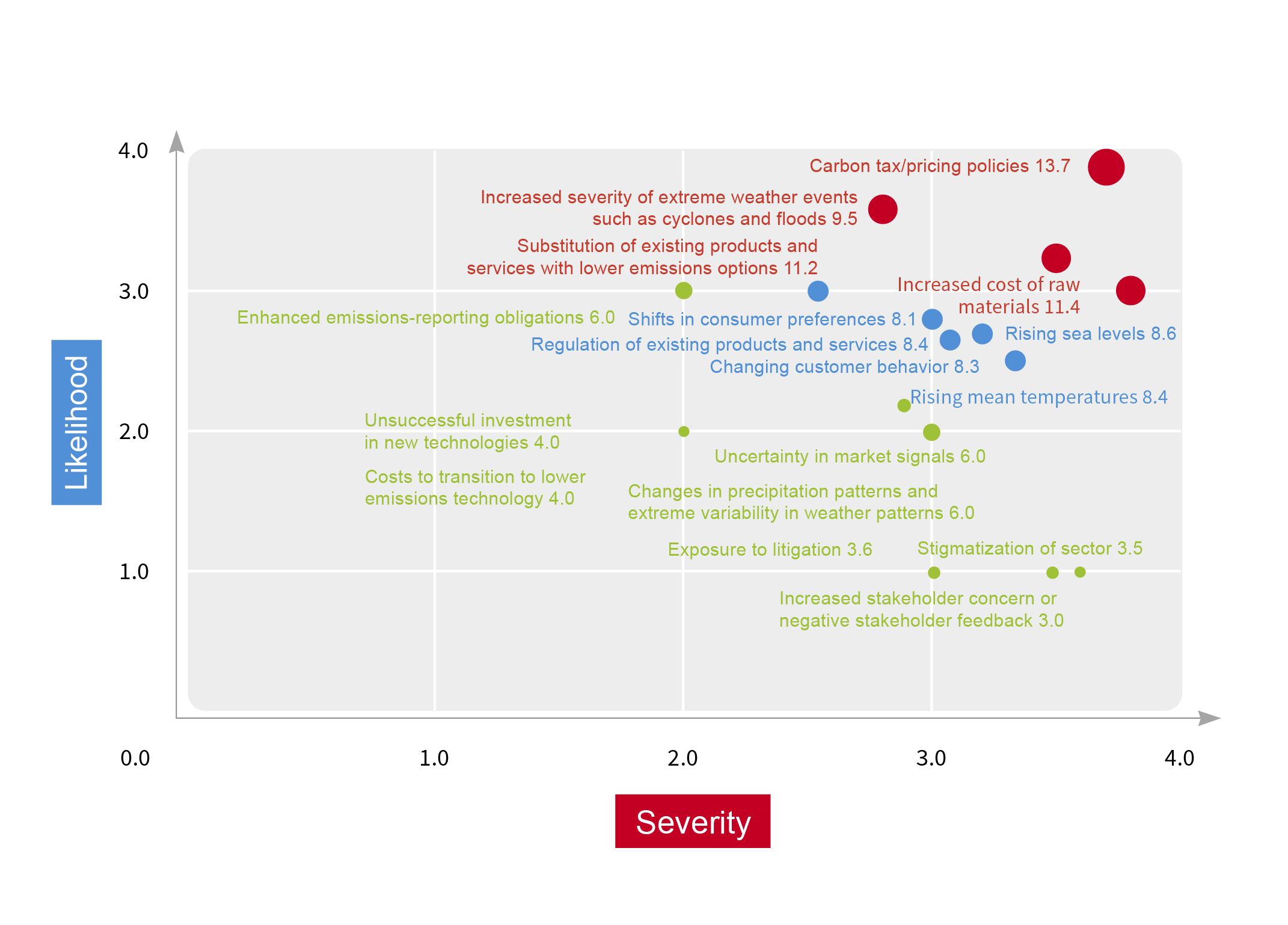

Based on the TCFD Risk Matrix, carbon management is one of the most critical issues. Relevant sub-issues include:

- Policy related to carbon taxes or carbon pricing may have a greater impact on the Company’s operation.

- Low-carbon transition risks associated with the need to gradually achieve carbon reduction targets in line with the shared goal of achieving net-zero emissions by 2050.

To devise actionable carbon reduction measures, in 2022, we engaged external experts to assist us in setting concrete carbon reduction targets and carbon reduction pathways for the next decade. The goal of reducing emissions by 24% compared to the 2021 level was proposed based on the emissions reduction goals set by National Development Council’s (NDC). We will conduct subsequent financial impact assessment and feasibility evaluation, based on which the plan will be submitted for board approval for implementation.

We have assessed the resilience of our carbon reduction strategies in the following scenarios:

Business-as-Usual (BAU)

No proactive decarbonization efforts are implemented and annual targets for emissions reduction are set at only 1%. In this context, while the transition risk to a low-carbon economy is not significant, acute physical risks (such as impact of extreme weather events on operations) and chronic risks (such as rising sea levels) would materialize. Under this scenario, organizations should strengthen their adaptation strategies.

Medium/Long-Term National Emissions Reduction Pathway

Under this scenario, emissions are reduced in accordance with the National Development Council’s (NDC) goal to cut greenhouse gas emissions by 24% by 2030, and net-zero emissions are achieved by 2050 as stipulated by the Climate Change Response Act. This scenario implies moderate low-carbon transition risk and low to moderate physical risks.

1.5℃ Pathway (the most ambitious decarbonization target)

The scenario represents a 50% emission reduction by 2030 and achieving net-zero carbon emissions by 2050. In this context, it is crucial to accelerate and strengthen decarbonization strategies. Otherwise the organization will face high transition risks. Physical risks are less significant under this scenario.

No Data Found

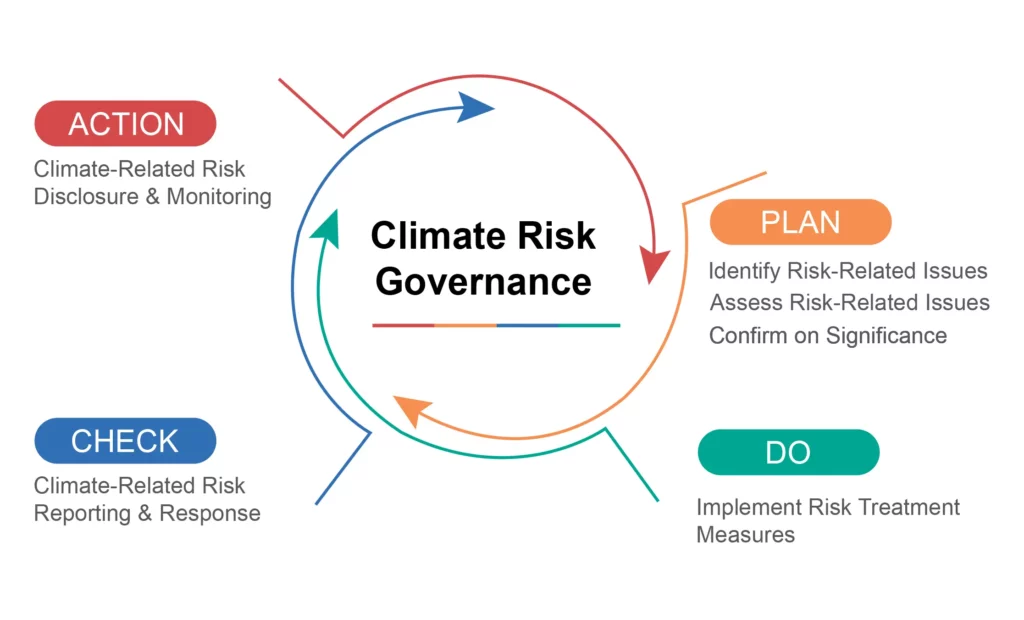

III. Risk Management

- Climate-related risks are classified as environmental risks. In 2021, the Environmental Team under the ESG Committee established an inter-departmental Climate Change Working Group to identify and evaluate climate-related risks and opportunities.

- We categorize climate-related risks into transition and physical risks. As part of the broader risk management system, we assess the potential transition and physical risks, including policy & legal, technology , reputation, acute and chronic risks, and how they may affect the Company.

- Risk assessment process: Risk identification => Risk prioritization => Risk impact assessment => Planning of adaptation and response measures, which will be integrated into the broader risk management system

➤ When a climate-related risk is considered a major risk, specific response measures will be proposed based on the risk management procedures.

- Risk reporting, response and monitoring: Each responsible unit continuously monitors risks related to operations, including tracking and confirming that the residual risks have been effectively controlled, and reports risk treatment results to the Risk Management Committee or at management system reviews, to serve as reference for the adjustment the Company’s risk control mechanism and operational strategies.

The Climate Change Working Group under the Environment Team of the ESG Committee is responsible for identifying and assessing related transition risks. The working group then reports the results upwards for development of response measures through the administrative system. The Risk Management Committee oversees the effectiveness of the Company’s climate change mitigation and adaptation measures.

Source of Risk | Source of Risk | Key Issue | Response to Opportunity/Risk | Performance Indicator | 2023 Target |

Transition | Changes in carbon-related policies and regulations | Carbon tax/pricing policies | 1. Implement energy management systems 2. Introduce comprehensive carbon footprint assessment and carbon risk management 1. Implement energy management systems 2. Introduce comprehensive carbon footprint assessment and carbon risk management 3. Develop sustainable products 4. Replace outdated and high-energy-consuming equipment, use low-carbon energy sources, increase energy efficiency, reduce GHG emissions intensity 5. Improve waste recycling rate 6. Improve water recovery rate | Progress on completing third-party ISO 50001 certification for energy management systems by 2023 Q3 | 100% |

Regulation of existing products and services | Progress on completing organizational carbon footprint assessment and third-party verification for parent company by 2023 Q3 | 100% | |||

Progress on completing third-party carbon footprint verification for selected products by 2023 Q4 | 100% | ||||

Reputation | Shifts in consumer preferences | Percentage of revenue from sustainable products (%) | ≧58% | ||

technology | Substitution of existing products and services with low emissions options | GHG emissions intensity reduction (tCO2e/NT$mm output) | ≦ 8.7 | ||

Market | Changing customer behavior | Water recovery rate (R2) | ≧ 84% | ||

Increased cost of raw materials | Waste recycling and reuse rate | ≧ 71% | |||

Physical | Acute | Increased severity of extreme weather events such as cyclones and floods | Improve drainage capabilities of production facilities in response to increased risk of heavy rainfall, enhance organizational resilience | Incidence of flooding at production sites due to heavy rainfall | 0 |

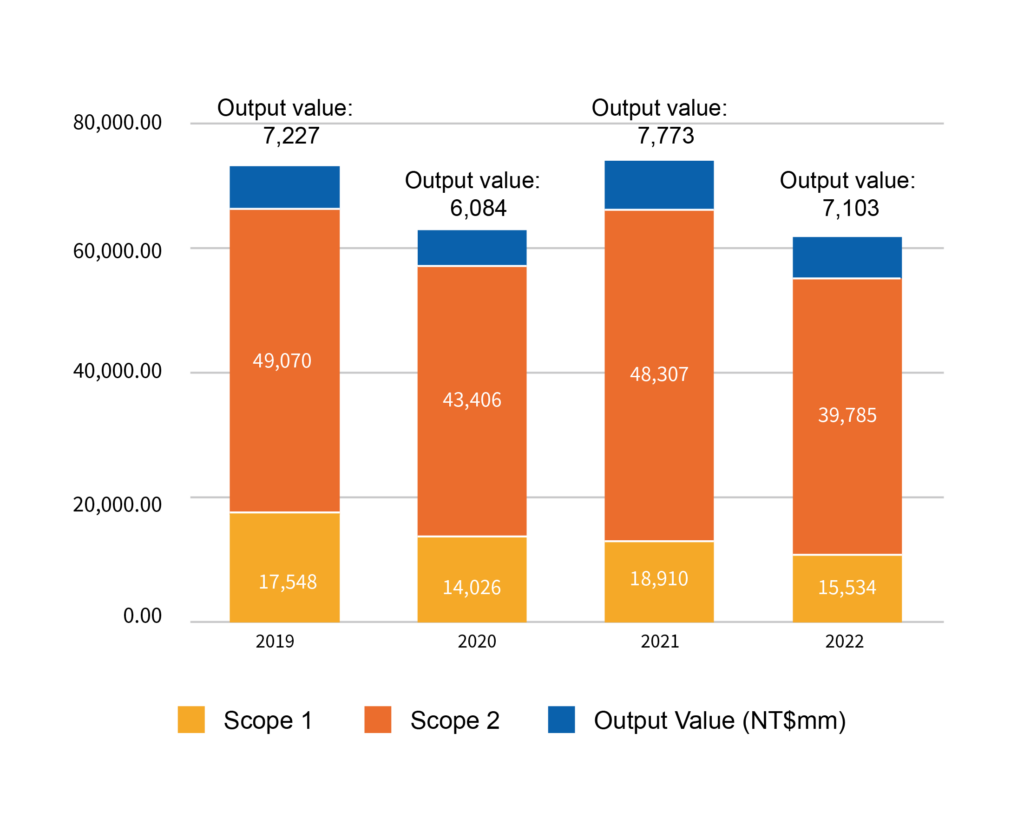

2019-2022 GHG Emissions

2020-2022 GHG Emissions Intensity (Everlight Chemical)

No Data Found

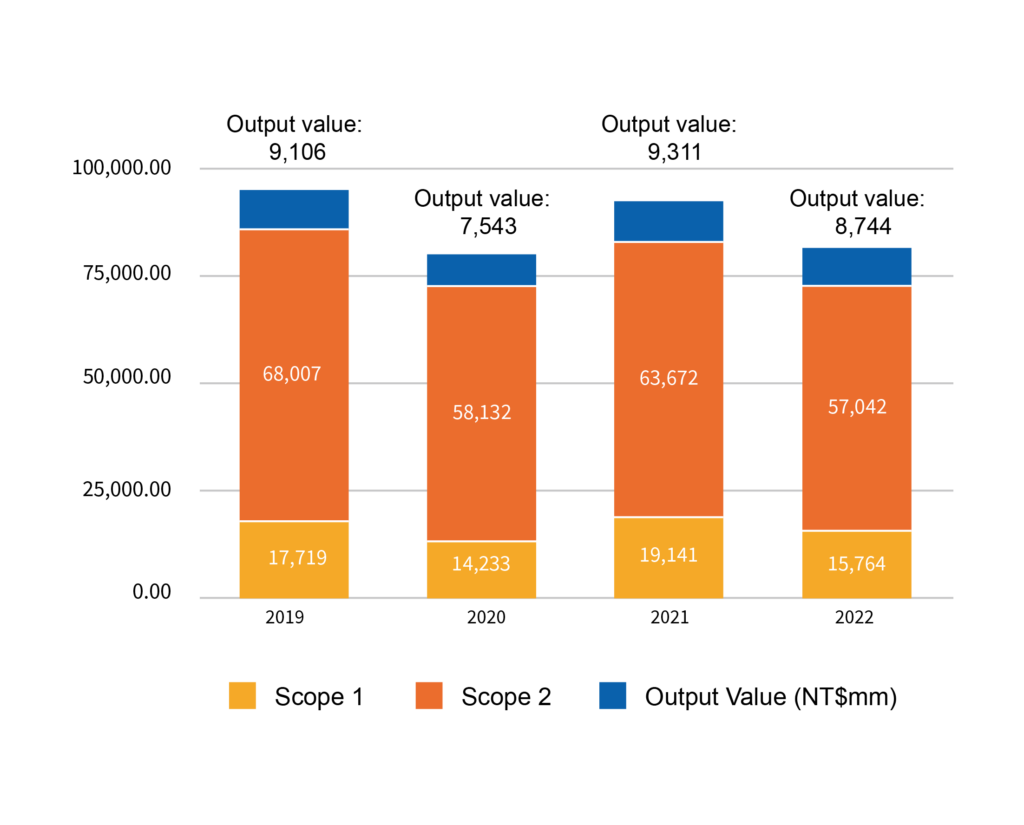

2020-2022 GHG Emissions Intensity (Group)

No Data Found

- To manage climate-related risks and opportunities, we have set the goal to reduce our medium-to-long term GHG emission intensity (tCO2e/NT$mm output).

- In 2022, through collective efforts, the Group successfully lowered the GHG emissions intensity by approximately 7% compared to 2021. Our medium-term targets are as follows.

Short/Medium/Long-Term Targets for GHG Emissions Intensity

GHG Emissions Intensity Performance & Targets (Everlight Chemical)

Unit: tCO2e/NT$mm